Media

Media

NEWS & UPDATES

Latest News From FSO

13 Mar, 2024

FSO Principal, Jeff Sherman, shares invaluable strategies on how to boost NOI in multifamily properties on the premiere episode of the Stage Debate Podcast with Cost Seg Isaac. Tune in to hear creative property management approaches and gain insightful perspectives on the current market.

21 Feb, 2023

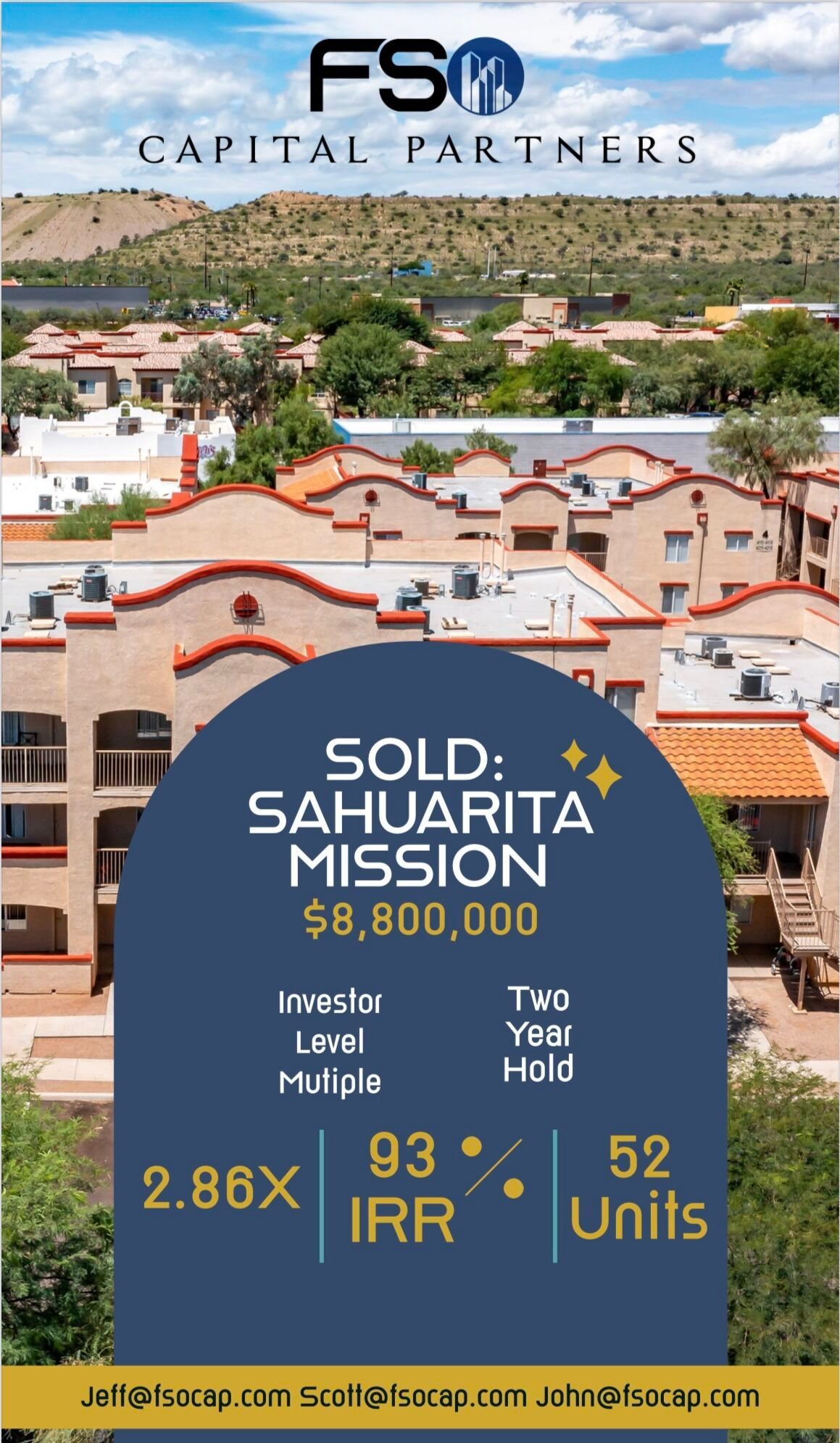

FSO Capital Partners, a real estate private equity firm based in Phoenix, has carried its remarkable momentum from last year into 2023. It recently sold a 52-unit multifamily property in Green Valley, Arizona for $8,000,000 to a California-based buyer. Sheila Hunter, Vice President and Senior Commercial Escrow Officer, in our Scottsdale office, closed this successful transaction. Read more: https://bit.ly/3rVStGm

15 Feb, 2023

FSO Capital Partners is pleased to announce the sale of Sahuarita Mission Apartments located in Green Valley, AZ. This beautiful 52 unit multifamily complex underwent a physical & operational repositioning. FSO was able to provide a 93% IRR & 2.86x multiple for our investors in just over two years. We greatly appreciate your support and continued success in these uncertain times!

07 Dec, 2022

FSO Capital Partners is proud to announce our most recent acquisition. 240 units in Yuma, AZ built between 2000- 2003, majority 3bd units, and was acquired for $35M, 145k/unit, and $140/SF. We closed with a 10-year fixed-rate Freddie Mac loan. Our rate was locked in at approximately 5.37% and pushed proceeds significantly during escrow - phenomenal execution. We are excited to add this project to our portfolio. A huge thanks to Northmarq for arranging the transaction.

26 Aug, 2022

Proud to announce FSO Capital Partners largest acquisition to date with the closing of Sonoma Valley Apartments in Apache Junction, AZ for $44,500,000, $250,000 per unit and $250/sf. This 176 property was built in 2001 and is comprised entirely of two and three bedroom units. We assumed an existing Fannie Mae loan with a 2.87% interest rate, 49% LTV, almost 3 years of interest only payments left and raised $24.8mm in equity.

19 Apr, 2021

On this episode, Scott and Chris discuss his career in brokerage before pivoting into principal. Scott details his 100 cold calls per-day strategy to become successful right out of the gate as a broker, the founding of FSO Capital Partners, and his Ice Hockey Career. Scott also gives advice to brokers who are looking to move to the principal side of real estate. Enjoy!

CONTACT US TODAY FOR MORE INFORMATION

Interested in Investing in One of Our Upcoming Projects?

FSO Capital Partners is a Phoenix private equity real estate firm specializing in the discovery and acquisition of undervalued multifamily properties.

QUICK LINKS

contact details

© 2024

All Rights Reserved | FSO Capital Partners | Website Built by REV77